All over Switzerland, property prices have risen massively in recent years. In most metropolises they have multiplied. New record highs are being reported from all parts of the country. We show why this is the case and why now could be the ideal time to sell your real estate holdings.

Why have prices been rising for years?

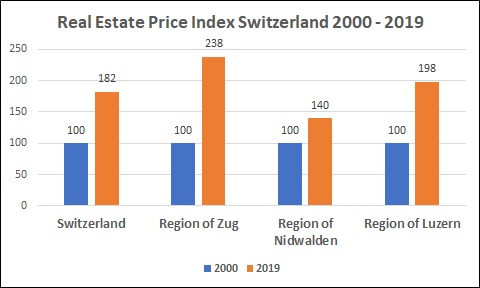

There are four main reasons. Their causes are partly still to be found in the financial crisis of 2007. But first things first. Here are the price increases for the whole of Switzerland and some regions:

These are index prices. In the Zug region, prices more than doubled on average. At the national level as a whole, prices have risen 82% in the last 19 years.

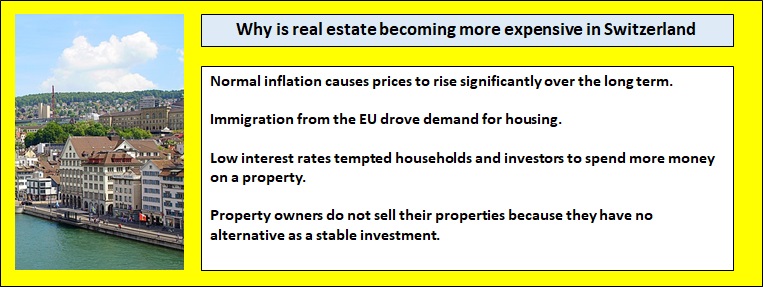

Usual inflation

Many people do not take it into account. But there has always been a normal rate of inflation in Switzerland. In some phases it was high, sometimes double-digit. There were times when it was very low. But you could always count on an average of about 2%.

Now consider that in 2009 a property cost around CHF 500,000. In 2021, its price would be CHF 634,120, assuming an annual inflation of 2%. This means that after 12 years a total price increase of 25% is completely normal anyway.

Immigration

The agreement with the EU on the free movement of labour allows citizens of the EU to settle in our country at any time and vice versa. These people contribute to our pension fund and pay taxes. Part of the GDP growth in recent years can be attributed to them. However, immigrants also need housing. However, the construction industry has not been able to respond that quickly. That is, increased demand with rapid growth caused prices to rise because supply could not catch up fast enough.

Low interest rates

Because of the low interest rates since the financial crisis, investors were willing to spend much more money on a property. You can’t put it in the bank, it doesn’t bring returns there. In addition, many citizens wanted to take advantage of the cheap loans to buy their own home. Here, too, high demand drove up the price massively.

Lack of supply

This situation was exacerbated by the fact that many owners of flats or houses no longer wanted to sell them. If you did, where would you put the money? No chance of returns, almost nowhere. The expert from Rotkorn Immobilien told us that one of the main reasons is actually this. A shortage of supply that meets a massive increase in demand.

Why now might be the best time to sell

Of course, one could now say: nothing has changed. So why not just carry on as usual? Of course, one can think that way, but possibly the peak has been reached. Interest rates are low, they are now even negative. It won’t get any lower. In the euro area, the USA and also here, the spectre of inflation is beginning to loom. Products are becoming more expensive. Even if the price increases are not driven by a massive boom in the labour market. Instead, it is mainly import prices for products from Asia and raw materials. The states could currently be tempted to raise interest rates. This would improve the exchange rate of their currency against the dollar and the yuan. Commodities and gold are traded in dollars, Chinese products in yen. This would dampen inflation somewhat. This video explains how it all fits together:

The consequences, however, would be more expensive loans. They in turn reduce demand for real estate, which would cause prices to tumble. And we are not talking about 1-2% here. Interest rates actually have a multiplier effect in real estate. If you raise interest rates from 0% to 1%, you trigger a whole quake in prices.

If you are currently “sitting” on some properties and living off their rental income, now would not be a bad time to get the most out of them. And you could invest the money relatively safely and earn a handsome return. Usually considerably more than from rents. Professional asset management, as it used to be reserved for the rich, is now available via robo-advisor virtually at the push of a button. Cryptocurrencies and P2P loans are another option. With sufficient diversification, you secure maximum profits over the long term and will make much more out of all that money.