When the financial assets of many citizens were destroyed during the years of hyperinflation in the Weimar Republic, a realization crystallized afterwards. All those who had invested their possessions in material assets survived this period with flying colors. They were as rich as before or even richer. While all those with government bonds and savings books were looking down the drain. One could think that shares would have been useful, but that is not true. In the crisis, so many companies went bankrupt that even stock portfolios imploded. We show what really helps in times of crisis.

How to secure money in crises?

One category of the lucky winners of the crisis were the people who owned real estate. They paid off the long-term loans for an “appeal and an egg” at the bank. Those who had taken out a loan in 1920 could pay it back in 1923 from petty cash. Whole apartment buildings were acquired in this way. In addition, the owners let their tenants pay them in kind, not in cash. So much for the protection of tenants during this period.

Well through the crisis came all those who played it safe in time. They put their money in gold and silver. Both elements are recognized worldwide as recognized means of payment. The prices fluctuate again and again, but it turned out that such precious metals also secure values in the long run.

Why buy osmium?

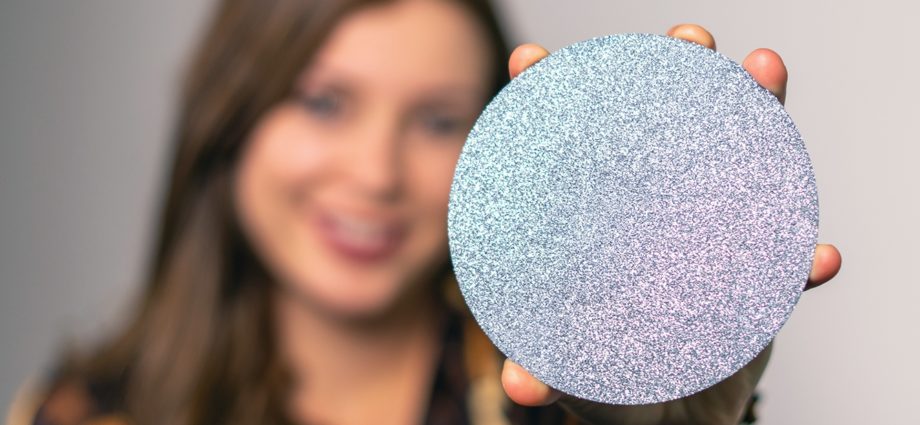

There are many good reasons to invest in precious metals. One of them is osmium. The experts at https://osmium-kaufen.org will explain the advantages it offers and its properties in detail.

One of the most important reasons for me would be the fact that gold and silver could already be overflowing. Whenever there is a crisis somewhere in the world, all investors run out and buy gold or silver. Most investors know only these two and therefore they buy it almost blindly. Such mass psychological phenomena always have a consequence: bubbles form, or at least people pay much more than necessary for a thing.

For this reason, osmium could currently be a good alternative. It is rather something for insiders, so that the market has not yet been completely flooded with panic money. This would have the positive effect that you would probably get more of the precious metal for every euro relative to the price of gold. For a protection of financial assets in any case an advantage. With osmium in your pocket any inflation loses its destructive power.

The disadvantage of this would be the fact that precious metals and raw materials do not yield interest and dividends. An investment in such classes serves mainly to protect values. Possible profits result solely from price increases.